2025 Tax Brackets Married Filing Jointly

2025 Tax Brackets Married Filing Jointly. Understanding the tax rates and income thresholds can help you plan your. These brackets are structured to accommodate household incomes effectively,.

Find the current tax rates for other filing statuses. Although you have $150,000 in net investment income, you will pay 3.8% in niit only.

2025 Tax Brackets Married Filing Jointly Images References :

Source: june2025calendarprintablefree.pages.dev

Source: june2025calendarprintablefree.pages.dev

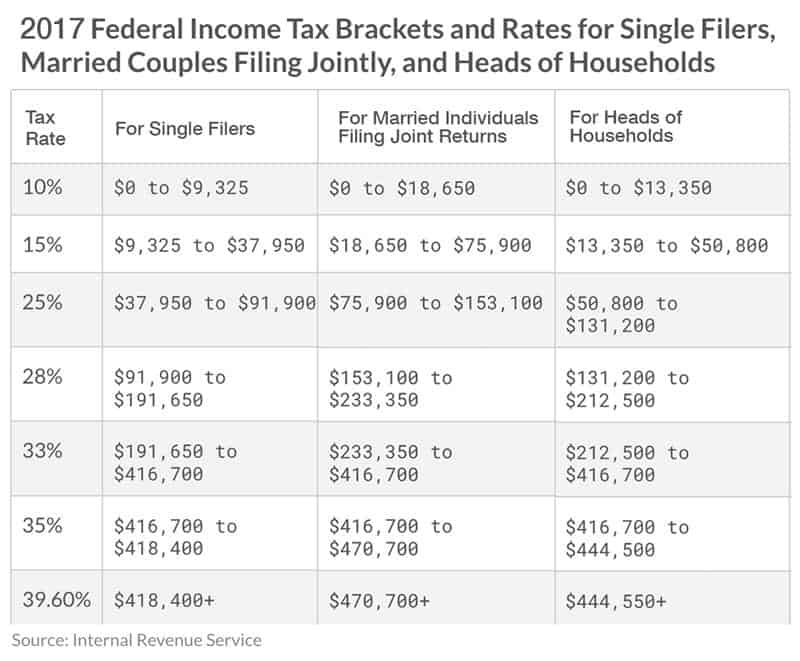

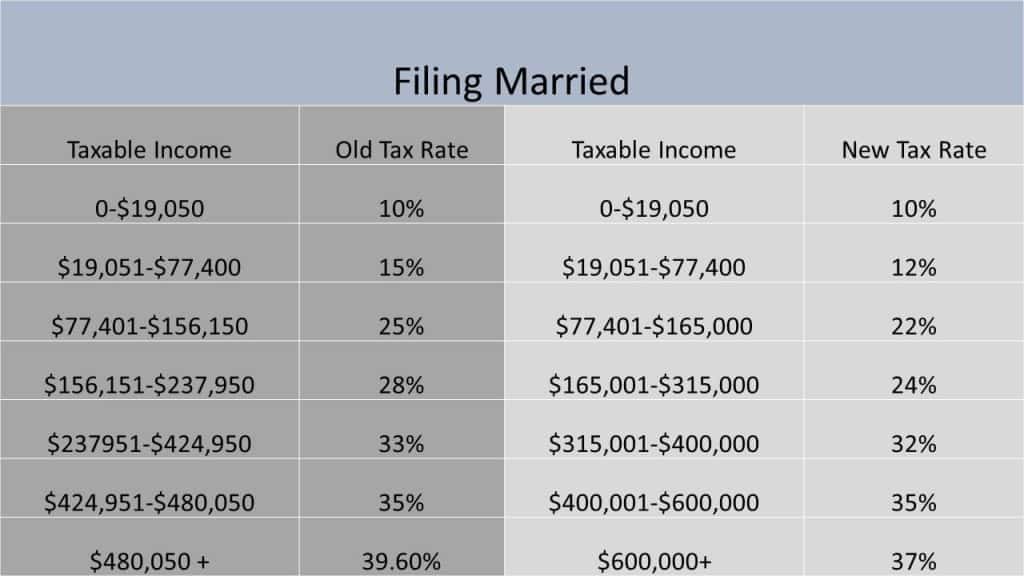

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, In the u.s., your income tax rate depends on your taxable income and filing status, which places you into one of seven tax brackets that range from 10% to 37%.

Source: carlmorrison.pages.dev

Source: carlmorrison.pages.dev

Federal Tax Brackets For 2025 Married Filing Jointly Carl Morrison, See current federal tax brackets and rates based on your income and.

Source: samchurchill.pages.dev

Source: samchurchill.pages.dev

In 2025 Sam Churchill, For the 2024 tax year, the exemption amount for single filers rises to $85,700 ($133,300 for married individuals filing separately) and starts to phase out at an income level.

Source: nellmargery.pages.dev

Source: nellmargery.pages.dev

Tax Brackets 2025 Married Jointly Theo Adaline, As the new tax year approaches, it's essential for married couples to be aware of the latest tax brackets for married filing jointly in 2024 and 2025.

Source: wpdev.abercpa.com

Source: wpdev.abercpa.com

marriedfilingjointlytaxbrackets, The 2025 tax year standard deduction for married couples filing jointly rises to $30,000 — an $800 increase from $29,200 for the.

Source: thephysicianphilosopher.com

Source: thephysicianphilosopher.com

How does the tax bill affect me and my paycheck? The Physician, Learn how federal tax brackets affect income and explore tips for lowering your tax bill this year.

Source: tamraqfernandina.pages.dev

Source: tamraqfernandina.pages.dev

Irs Tax Tables 2025 Married Jointly Caril Cortney, The capital gains tax rates will remain at 0%, 15%, and 20%, but the income.

Source: evvybalameda.pages.dev

Source: evvybalameda.pages.dev

2024 Standard Deduction For Married Couples 2024 Suzi Yevette, Discover 2025 tax brackets, standard deductions, and credits.

Source: felizabmorgen.pages.dev

Source: felizabmorgen.pages.dev

Tax Bracket 2024 Married Filing Separately 2024 Dusty Glynnis, Taxpayers can file as single, married, jointly filed, married, separately filed, or head of household, each category having its income limits that define which tax rate applies.

Source: elsabjemimah.pages.dev

Source: elsabjemimah.pages.dev

Tax Brackets 2024 Married Jointly Single Bobbe Chloris, Understanding the tax rates and income thresholds can help you plan your.

Posted in 2025